Invest Cyprus takes the lead in attracting and facilitating Foreign Direct Investment in key economic sectors, working with the investor, for the investor. Dedicated to continuously improving the business and regulatory environment, Invest Cyprus advocates reform while providing continuous investor support and aftercare services.

Invest Cyprus is a member of the World Association of Investment Promotion Agencies (WAIPA) and the Mediterranean Investment Network, ANIMA.

Strategic location

With its ideal geographical position at the crossroads of three continents - Europe, Africa and Asia, Cyprus plays a key stabilizing role in the region of the Eastern Mediterranean.

The island is an ideal investment gateway to the European Union, as well as a portal for investment outside the EU, particularly into the Middle East, India and China.

Tax System

Cyprus offers an attractive and transparent tax regime, fully compliant with EU, OECD and international laws and regulations. Its main features are:

• One of the lowest corporate income tax rates in the EU at 12.5%

As a member of the European Union since 2004 and the European Monetary Union since 2008, Cyprus is committed quality, efficiency and transparency in transactions.

Its EU membership ensures safety and stability for investors, also offering them market access to more than 500 million EU citizens.

Legal and Regulatory Framework

Based on English Common Law principles, Cyprus’ comprehensive and robust legal and regulatory framework, is widely recognized as a business-friendly and effective system that ensures transparency and reliability in business practices.

Offering foreign businesses a familiar and reliable framework within which to operate, Cyprus’ legal system is also fully compliant with the EU, the Financial Action Task Force on Money Laundering (FATF), OECD, FATCA, the Financial Stability Forum laws and regulations and EU AML directives.

Human Talent & Quality of Professional Services

Human talent constitutes one of Cyprus’ most compelling advantages, complemented by a Broad range of high quality professional services.

As a dynamic business center, Cyprus offers an abundance of highly educated and skilled Individuals, multilingual in their majority, ready to serve the needs of any business. Cyprus Ranks amongst the top countries in Europe for tertiary education per capita.

High Quality of Life

Cyprus offers an enviable lifestyle in a safe, clean and healthy environment with high living standards. Low crime levels, year-round sunshine, centuries of art and culture, and a delicious gastronomy all contribute to a high quality of life.

Safety is amongst the biggest advantages of Cyprus, which has been ranked the safest smaller country in Value Penguin’s Safest Countries in the world (2015) and fifth worldwide.

Economic Prospects & Opportunities

The government’s commitment to the continuous introduction of progressive measures for reform and growth has resulted in the impressive recovery of the Cypriot economy, much earlier than expected. Cyprus constitutes today a success story for the EU, a fact enhanced by continuous upgrades from credit rating agencies, such as Standard & Poor’s, Fitch and Moody’s.

By continuously enhancing and developing key economic sectors, introducing structural changes and important reductions in expenses and operational costs, Cyprus has regained its credibility and reinforced its competitiveness as an attractive investment destination offering numerous opportunities and potential.

Real Estate - Large Projects

Acquiring property in Cyprus, either as an investment or as a second home, has always been a popular choice among foreign investors. A combination of high quality of life, year-round sunshine and natural beauty, ease of doing business and investment incentives offer investors an attractive experience in terms of both living and doing business.

Shipping

Cyprus is a renowned International Shipping Centre and home to some of the world’s leading names in the global shipping industry, such as the Italian MSC Mediterranean Shipping Company, the German-owned Bernhard Schulte Shipmanagement and the Russian Unicom Management Services.

The maritime sector has historically been one of Cyprus’ most successful industries. Capitalising on its strategic location at the crossroads of busy sea trade routes and offering attractive legislative and operational shipping infrastructure, a solid and efficient tax framework and an excellent communications network, Cyprus has successfully built a diversified and robust maritime industry that accounts for over 7% of the country’s GDP (including auxiliary services). Currently more than 1,022 registered vessels with a 21 million gross tonnage are registered under the

Cyprus flag making Cyprus the:

• 10th largest merchant fleet in the world

• 3rd largest merchant fleet in the EU

• Top 3 Ship Management Centre globally

• Largest third party Ship Management Centre within the EU

Cyprus has an EU-approved “Open Registry” regime, one of the only two ‘Open Registries’ in the EU, with a very wide and legally endorsed Tonnage Tax System (TTS), which was introduced with the Merchant Shipping Law in 2010 and covers the three main “maritime transport” activities, namely ship-owning, ship-management (crew and technical management) and chartering. The simplified Cyprus Tonnage Tax System represents a compelling competitive advantage and contributes significantly to the already strong position of the country in the global shipping world.

Owners of Cyprus flag ships fall automatically under the tonnage tax regime, whereas ship owners of foreign flag ships, charterers and ship managers may opt to be taxed under the tonnage tax system (TTS) under certain conditions.Over 150 ship-owning, ship-management, chartering and shipping related companies control a merchant fleet of 2,300 vessels with a 50 million gross tonnage, while employing approximately 4,500 employees and 55,000 seafarers.

Cyprus maintains a wide range of competitive advantages through a high quality maritime cluster, offering efficient and quality services, including:

• The latest EU-approved Tonnage Tax System (TTS) with no direct link to corporate tax

• Competitive ship registration costs and fees

• No crew/officer nationality restrictions

• 28 Merchant Shipping Bilateral Agreements

• Signatory to all international maritime conventions on safety, security and pollution prevention

• Full protection for financiers and mortgagees

• White List of Paris and Tokyo MoUs

Tourism

Tourism has traditionally been a major source of income and a driver of economic growth in Cyprus, with a significant contribution to the country’s GDP. Being one of Cyprus’ most resilient and strong economic sectors, tourism continuously experiences substantial growth, translated into a number of more than 2.5m tourists visiting Cyprus every year.

Competitive advantages

Cyprus is well known for the hospitality of its people, its delicious gastronomy, its rich culture and extraordinary natural beauty. With its golden sandy beaches and clear blue waters, as well as its pleasant Mediterranean climate with year-round sunshine, Cyprus has been a popular tourist destination for decades. The island’s famous beaches have been awarded with 57 Blue Flags in 2015, ranking the island first in the EU for the tenth consecutive year, including three records:

• most Blue Flags per capita in the world

• most dense concentration of Blue Flag Beaches

• most Blue Flag beaches per coastline

Cyprus’ tourism industry has gained several prestigious awards, including the Sustainable Destinations Global Top 100, VISION on Sustainable Tourism and Totem Tourism and Green Destination titles presented to Limassol and Paphos in 2014.

But there is much more to Cyprus than just sun and sea. Cosmopolitan and culturally rich, Cyprus offers a variety of tourism options that cater to all tastes and desires, whether it be sports, historical and cultural attractions, luxury resorts, wine routes, nature trails and ecotourism in traditional villages.

The island has all the prerequisites to further develop this industry and offers great potential for investments in niche areas such as Health & Wellness, Sports, Luxury and Lifestyle tourism.

Tourism Strategy

Enhancing and diversifying the tourism product is one of the primary objectives of the Government and the relevant authorities, which aims to achieve high value–added tourism from traditional as well as emerging tourism markets. Extending seasonality and improving connectivity is right at the heart of the government’s tourism policy, continuously striving to maximise the island’s potential, preserving and showcasing Cyprus’ local cultural treasures, improving existing infrastructure and the quality of services offered, whilst promoting the advancement of new tourism sub-sectors, such as religious and cultural tourism, sports tourism and health and wellness tourism.

Large-scale development projects

A number of large-scale development projects, such as leisure & theme parks, luxury resorts, marinas, tourism resorts and golf courses are underway, attracting significant levels of foreign investment. Tourism is also now gaining momentum with the creation of a single Integrated Casino Resort, a landmark attraction that will add value to the island’s tourism product. The new casino aspires to becoming the leading Integrated Casino Resort in Europe and amongst the best in the world, exceeding five-star requirements and offering numerous leisure services such as hotels, spas and conference centres. Moreover, following the success of the Limassol Marina, new luxury marinas are also in the pipeline for Larnaca, Ayia Napa, Paralimni and Paphos.

Health and Wellness Tourism

Another sub-sector under development is health and wellness tourism, which is a fast-developing industry that combines medical & wellness treatment with rehabilitation and holiday options. The country already fulfils a number of important criteria, such as an accessible location, a mild Mediterranean climate all year round, an existing network of high-quality hospitals and clinics, luxury resorts and existing tourism infrastructure, a multilingual, skilled workforce, as well as the expertise of internationally educated doctors.

Cyprus offers world-class reputation for high-quality private health care in a technologically advanced environment, with 6 public hospitals and approximately 80 private clinics. Following the introduction of the EU Directive on Cross Border Healthcare in 2013, EU citizens are free to choose between a variety of healthcare solutions and treatment abroad, thus opening up further possibilities for Health and Wellness Tourism in Cyprus.

Cyprus sees record-breaking arrivals every year and with new projects on the way, aims at further enriching its product and maintaining its position as a leading tourism destination in the world.

Professional Service

Cyprus is widely recognised as a centre of excellence in the provision of professional services. With an abundance of highly-skilled and experienced multilingual professionals, Cyprus offers a full range of modern, advanced professional services at competitive rates. Lawyers, attorneys, auditors, tax advisors, financial advisors and other specialists, who are often educated at the best universities worldwide, offer high-quality services to support all types of businesses, from large listed entities to family offices and entrepreneurs.

Further evidence of Cyprus’ recognition as a reputable international financial and business center is the decision of two of the world’s leading accounting organizations, the Institute of Chartered Accountants in England and Wales (ICAEW) and the Chartered Institute of Management Accountants (CIMA), to select Cyprus as the first country in the world outside the United Kingdom to train ICAEW and CIMA accountants.

Cyprus offers a wide range of professional accounting, auditing, management consultancy, and taxation, financial advisory and other administrative services to both the private and public sectors. With top international accounting firms also established in the island providing services to local as well as international investors, there are currently

• More than 4000 active, English-speaking, registered accountants and

• More than 120 limited accounting firms and 40 partnerships operating in Cyprus;

While in accounting Cyprus follows the International Financial Reporting Standards (IFRS), the country’s legal system is based on English Common Law principles, incorporating the body of laws and regulations of the EU known as the acquits communautaire.

The legal industry, with over 3,000 registered advocates, that in their majority studied and/or qualified in the UK and other top worldwide destinations, and more than 160 limited liability law firms provide a wide range of high quality legal services in areas such as international law, corporate administration and management services, while most large law firms are affiliated or collaborate with international law firms.

Oil & Gas

The discovery of hydrocarbons in Cyprus’ Exclusive Economic Zone (EEZ) has created new and exciting prospects for Cyprus to become an energy hub in the Eastern Mediterranean. Prospects in the energy sector are all the more promising thanks to the island’s geostrategic location, connecting Europe and the Black Sea with markets in the Middle East and Asia and its role as a pole of stability and security in the region of the Eastern Mediterranean.

Aphrodite gas field is an offshore gas field off the southern coast of Cyprus located at the exploratory drilling block 12 in the country's maritime Exclusive Economic Zone. Located 34 kilometers (21 mi) west of Israel's Leviathan gas field, block 12 is believed to hold 3.6 to 6 trillion cubic feet (100×109 to 170×109 m3) of natural gas.[4][5]

Noble Energy received the concession to explore block 12 in October 2008.[6] In August 2011,

Noble entered into a production-sharing agreement with the Cypriot government regarding the block's commercial development.[7] Sources in Cyprus indicated in mid-September that Noble had commenced exploratory drilling of the block.[8]

Cyprus demarcated its maritime border with Egypt in 2003, and with Lebanon in 2007.[9] Cyprus and Israel demarcated their maritime border in 2010.[10] Turkey, which does not recognize the border agreements of Cyprus with its neighbors,[11] threatened to mobilize its naval forces should Cyprus proceed with plans to begin drilling at Block 12.[12] Cyprus's drilling efforts have the support of the United States, European Union, Russia and United Nations, and on September 19, 2011 drilling in Block 12 began without any incidents being reported.[13] The development of oil and gas resources in the Cypriot Exclusive Economic Zone (EEZ) abide to the UN Convention of the Law of the Seas (UNCLOS) which the Republic of Cyprus ratified in 1988.[14] The United Kingdom also has a claim on the area resulting from its sovereignty over two base areas in Cyprus. The treaty establishing the Republic of Cyprus (Annex I, Section III) specifically excluded any Cypriot claim to the two areas adjacent to the bases.[15][16]

For the Cyprus population the Aphrodite gas field can boost the local economy to counter rising unemployment. According to Noble Energy, a total gross unrisked deep oil potential is 3.7 billion barrels (590×106 m3). The field has a gross mean average of 7 trillion cubic feet (200 billion cubic meters) of natural gas with an estimated gross resource range of 5–8 trillion cubic feet (140×109–230×109 m3).[17][18] Recent developments have attracted worldwide interest and significant investments from leading international energy giants, such as Noble Energy, Delek, Total, ENI and KOGAS, ExxonMobil as well as renowned international providers operating in the oil and gas auxiliary services sector. Comprehensive strategies are being developed to exploit the country’s wealth not only for local needs, but also for export purposes.

Exploration licences have been granted for several offshore blocks within Cyprus’ EEZ. A consortium of Italy’s ENI and Korea’s KoGas are also exploring three offshore blocks while French oil major Total has exploration rights over one block in the Cyprus EEZ. US firm Noble Energy, operating block 12, the ‘Aphrodite’, and also developing Israeli Tamar and Leviathan gas fields, found an estimated 4.5 trillion cubic feet of natural gas, enough to meet Cyprus’ domestic gas demand for over 100 years. An initial development and production plan for ‘Aphrodite’ had been submitted in March 2015, while Cyprus is expected to make 70% of the profits from the liquefaction of natural gas. Investments of approximately €3 billion will be needed to build the exploitation structures of the field and the pipelines towards Egypt.

The 3rd licencing round was successfully completed with 6 offers from 8 companies for plots 6,8,10. Both existing and new companies such as ExxonMobil, Qatar Petroleum and Statoil, have placed their bids, showing the continuously increasing international interest for Cyprus’ new oil and gas realities.

Emphasis has also been given on fostering multilateral cooperation with neighbouring countries in exploiting the reserves and building prospective regional pipelines. Regional cooperation has been successfully enhanced through agreements signed with Israel, Egypt and Lebanon, while Egypt and Cyprus have signed a deal for the transfer of natural gas via pipeline. The deal allows a direct subsea pipeline from Cyprus’s exclusive economic zone (EEZ) to either Egypt’s EEZ or onshore Egypt, for domestic consumption or re-export.

Recent developments have attracted worldwide interest and significant investments from leading international energy giants, such as Noble Energy, Delek, Total, ENI and KOGAS, ExxonMobil as well as renowned international providers operating in the oil and gas auxiliary services sector. Comprehensive strategies are being developed to exploit the country’s wealth not only for local needs, but also for export purposes.

Exploration licences have been granted for several offshore blocks within Cyprus’ EEZ. A consortium of Italy’s ENI and Korea’s KoGas are also exploring three offshore blocks while French oil major Total has exploration rights over one block in the Cyprus EEZ. US firm Noble Energy, operating block 12, the ‘Aphrodite’, and also developing Israeli Tamar and Leviathan gas fields, found an estimated 4.5 trillion cubic feet of natural gas, enough to meet Cyprus’ domestic gas demand for over 100 years. An initial development and production plan for ‘Aphrodite’ had been submitted in March 2015, while Cyprus is expected to make 70% of the profits from the liquefaction of natural gas. Investments of approximately €3 billion will be needed to build the exploitation structures of the field and the pipelines towards Egypt.

The 3rd licencing round was successfully completed with 6 offers from 8 companies for plots 6,8,10. Both existing and new companies such as ExxonMobil, Qatar Petroleum and Statoil, have placed their bids, showing the continuously increasing international interest for Cyprus’ new oil and gas realities.

Emphasis has also been given on fostering multilateral cooperation with neighbouring countries in exploiting the reserves and building prospective regional pipelines. Regional cooperation has been successfully enhanced through agreements signed with Israel, Egypt and Lebanon, while Egypt and Cyprus have signed a deal for the transfer of natural gas via pipeline. The deal allows a direct subsea pipeline from Cyprus’s exclusive economic zone (EEZ) to either Egypt’s EEZ or onshore Egypt, for domestic consumption or re-export.

Moreover, Cyprus offers a secure and convenient base for operations for various auxiliary services to the oil and gas industry as well as for company headquarters to support activities in the EMEA region.

An important step in Cyprus’ ambitious plan to evolve as a regional energy hub is the operation of a €300 million oil storage terminal, which opened for business in November 2014, designed and constructed by VTTI Energy Partners LP. Its strategic location makes it the first terminal of its kind in the Eastern Mediterranean, connecting Europe and the Black Sea with markets in the Middle East and Asia. The asset currently comprises 28 tanks and capacity of 544,000m³, and offers access to a deep water marine jetty, as well as to road tanker loading facilities. A Phase 2 expansion is currently under evaluation and would create an additional 13 tanks and further capacity of 305,000m³, while the existing Larnaca oil storage facilities are relocated to Vasilikos as well.

Energy

Renewable Energy

The energy policy of Cyprus is harmonized with the European Union goal of promoting the use of energy from renewable sources, as a major step towards the reduction of global warming and climate change phenomena.

The EU RES Directive sets out specific national targets to be achieved by each individual Member State, regarding the share of RES generated in each Member State by the year 2020. For Cyprus, the national target states that the share of energy produced from RES must be at least 13% out of the gross national final consumption of energy in 2020.

In light of the above, the Cyprus Government has launched a number of financial measures in the form of governmental grants and/or subsidies, which aim at providing support and incentives for the promotion of RES-E utilization in Cyprus. The main types of RES technologies which are promoted under these measures for integration in the Cyprus power system are the following:

• Solar energy

• Wind energy

• Biomass

Cyprus ranks first in the world in solar energy use for water heating in households, and has achieved significant progress in the production of energy from Renewable Energy Sources (RES).

Cyprus has already exceeded its intermediate 2020 targets, with RES comprising of about 8.7% of its total electricity generation, compared to the 7.45% threshold for 2015- 2016. In addition, Cyprus holds the EU-28 record according to the “European Solar Thermal Industry Federation” for use of solar water heating systems per capita. Currently, more than 93% of households and 52% of hotels in Cyprus heat water through solar power heating systems.

Cyprus is on track in achieving its Renewable Energy Sources (RES) target, i.e. to supply 13% of the island’s energy by 2020.

The most important projects relating to power generation from RES concern wind parks and photovoltaic (PV) parks, concentrated solar thermal plants and biomass and biogas utilisation plants. 6 wind parks are currently in operation, while as regards solar energy, 4 PV parks have been connected to the national grid so far, generating 1,000,000 kWh.

Renewable energy is definitely rising and is expected to experience considerable growth in coming years, while the Cyprus government is also welcoming companies with expertise in renewables to bring their operations, know-how and advanced technology to the country.

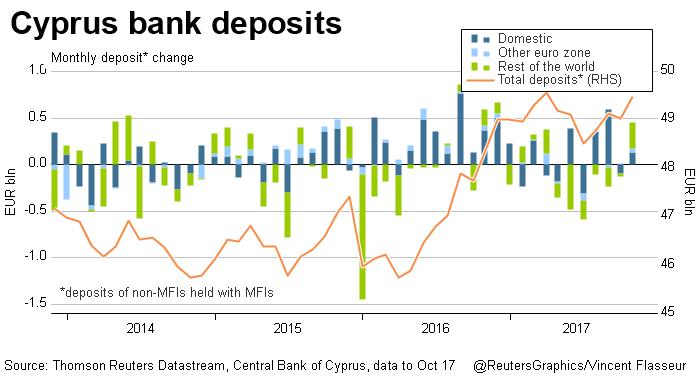

Banking, Financial Services

Cyprus has a sophisticated and advanced financial services sector, which is expanding rapidly year on year.

Banking is the largest component of the sector, having emerged strong, fully recapitalized and well-regulated out of the financial crisis of prior years. The banking system is fully harmonized with EU legislation and directives. Commercial banking arrangements and practices follow the British model and there are currently over 40 Cypriot and international banks operating in Cyprus. All banks maintain correspondent networks around the world and carry out both traditional and specialized financial transactions.

The Cyprus financial services sector is diverse, comprising of domestic banks, International Banking Units (IBUs), insurance companies, and other companies that offer financial intermediation services. A significant number of international banks operate subsidiaries, branches or representative offices in Cyprus. Banks located in Cyprus offer an array of services ranging from asset management, private banking, international, corporate and investment banking, retail banking, syndicated loans, custodian services and more. In line with business changes, Cyprus’ banking infrastructure has rapidly evolved and adopted the use of advanced technology systems, implemented measures to improve risk management and acquired highly-trained personnel.

For a complete list of credit institutions operating in Cyprus, visit the website of the Central Bank (www. centralbank.gov.cy).

Cyprus’ banking and financial services sector legislation is in line with international best practices and has a simplified. Combined with an effective and transparent tax system, which is fully EU, OECD, FATF, FSF and MONEYVAL compliant, the banking sector is in a position to service clients of all sizes and industries.

The Central Bank of Cyprus, an autonomous institution established in 1963, is the supervising authority of the banking system in Cyprus. The Central Bank of Cyprus follows the Basel Committee and European Union banking regulation directives. In January 2008, the Central Bank of Cyprus was integrated into the Euro system under the European Central Bank.

Other regulatory authorities involved in the monitoring of financial institutions include:

• The Cyprus Securities and Exchange Commission

• The Co-operative Credit Societies’ Supervision and Development Authority

• The Commissioner of Insurance Companies (Ministry of Finance)

• Authority for the Supervision of Pension Funds (Ministry of Labor, Welfare and Social Insurance)

Investment Funds

Cyprus is fast becoming one of the top emerging investment fund centres in Europe thanks to its continuous efforts to upgrade its legislative and regulatory regime, and its strong network of financial and professional services providers. Determined to stay at the forefront of industry developments, Cyprus offers unique access to high-growth markets, compliance with EU fund regulations and international best practices, as well as high quality and cost-efficient support services. The country’s population is one of the most highly educated within the EU, and the expertise of its service providers has established Cyprus as a location of choice for international fund promoters and investors seeking secure and advantageous fund solutions. Service providers support funds throughout their entire life cycle: regulatory approval, administration, custody, annual audit, listing on the Cyprus Stock Exchange (if applicable), order routing, registration, clearing and settlement.

The Cypriot regulatory authorities have worked diligently to bring the funds’ framework in Cyprus up to par with other international jurisdictions.

These efforts include the transposition of the Undertakings for Collective Investment in Transferable Securities (UCITS) IV Directive in 2012 and the Alternative Investment Funds Managers Directive (AIFMD) in 2013. Through the laws transposing these two directives, Cyprus offers a European passport to the fund management industry and outstanding possibilities for cross-border and global fund distribution.

The alternative investment funds industry in Cyprus has experienced significant growth in the last few years, with the establishment of a significant number. of both UCITS Management Companies and UCITS funds, a trend which is expected to continue.

In an effort to further enhance and grow the Cyprus Investment Funds Industry, the Cyprus Investment Promotion Agency (CIPA) established the Cyprus Investment Funds Association (CIFA), as a natural development of the progress made in promoting Cyprus as a competitive investment funds jurisdiction. In extending its local network, CIFA has established close cooperation with the competent Regulatory Authorities, the Ministry of Finance as well as the relevant Industry Associations and Professional Bodies. At an international level, CIFA is taking the necessary steps to become a national member of widely recognized and respected international bodies. In 2016, CIFA was granted full membership of the European Fund and Asset Management Association (EFAMA).

The increasing number of applications being received by the Cyprus Securities and Exchange Commission (CySEC) for Cyprus Investment Firms (CIFs) is indicative of the enduring attraction of Cyprus as an investment base. The number of CIFs has registered an impressive increase over the years, surging from 50 in 2005 to 195 in June 2015, with the trend expected to continue.

Insurance Services

Cyprus undertook a thorough review of its insurance legislation in 2002, in preparation for accession to the EU in 2004. The Law on Insurance Services and Other Related Issues of 2002 took effect on January 1st, 2003 and has since been updated to maintain full compliance with all EU directives. The law aims to protect policyholders’ interests, ensure confidence in and stability of the insurance market and achieve market transparency.

The Insurance Law covers local insurance companies, insurance companies incorporated in another EEA (EU together with Norway, Iceland and Lichtenstein) state and third-country (non-EEA) insurance companies. The requirements are broadly similar for all, except that certain exemptions are available for companies regulated in another EEA state.

Τhe Insurance Companies Control Service established under article 4 of the Insurance Law, is responsible for supervising the operations of insurance companies.

Education

Cyprus aspires to become an established educational and research centre of excellence in order to achieve sustainable growth and support all sectors of the economy. The Ministry of Education and Culture is converging all necessary reforms and is greatly supporting and facilitating FDI in Education and Research.

The Cyprus educational system is centralised and fully regulated by the Ministry of Education and Culture. In 2015, Cyprus easily exceeded two of the headline targets for Education set under the Europe 2020 strategy: the percentage of entry leavers from education and training as well as the tertiary education attainment rate. According to the latest available data, Cyprus has the highest tertiary education percentage within the EU (2015: 54.6% in Cyprus compared to 38.7% EU average), while public expenditure on education was 5.8% in 2014 compared to a 4.9% EU average.

Cyprus Education at a Glance

Compulsory education in Cyprus lasts for ten years and covers the ages from approximately 5 years (pre-primary education) to 15 years (end of lower secondary education). Education is free for all ages up to 18 years.

Early childhood education and care is organised in pre-school and pre-primary systems. The pre-school system involves day nurseries for children under the age of 3. The pre-primary system involves nursery schools for children aged 3-6. Primary education is offered in primary schools and comprises a six-year course of general education beginning around the age of 6. Lower secondary education, between the ages 12-15 is offered in the gymnasium and it comprises a three-year course of general education.

Upper secondary education for children aged 15-18 years, is offered in two different types:

• Secondary general education, which is offered at lyceums and includes both common core and optional subjects of specialisation

• Secondary technical and vocational education which is offered at technical schools and includes a theoretical and a practical stream of apprenticeship.

The vast majority of graduates of upper secondary education continue their studies at tertiary level of education, either in Cyprus or abroad.

Post-secondary non-tertiary education programmes, lasting two years, are offered to graduates of secondary education (18+) at Post Secondary Institutes of Vocational Education and Training.

Higher education is offered in public and private institutions, both at University level and non-University level.

Private secondary schools are established by private bodies or individuals and they are registered with the Ministry of Education and Culture which is responsible for their supervision.

The Republic of Cyprus has established a favourable higher education framework for the operation of public and private institutions targeting quality, investing in infrastructure and attracting highly qualified human talent. Cyprus, as a member of the Bologna process, focuses on employability, lifelong learning, internationalisation, student and staff mobility with great emphasis in enhancing quality education.

Currently, there are 3 public and 5 private universities with the average duration of undergraduate courses being four years and the language of instruction either Greek or English. There are also five public higher education institutions with no university status, offering courses ranging from one to three academic years. Around forty private higher education institutions offer academic and vocational programmes of study at both undergraduate and postgraduate level.

The main source of funding for public universities derives from the national budget, fees paid by post-graduate students, donations and national or EU research programmes. Private institutions receive their funding mainly from student fees and research contracts.

Quality assurance falls under the authority of the Cyprus Agency of Quality Assurance and Accreditation in Higher Education that aims to enhance internal and external quality assurance procedures as well as accreditation matters in accordance with European Standards and Guidelines. The Cyprus Council for the Recognition of Higher Education Qualifications is the national competent authority for the recognition of higher education qualifications in Cyprus.

Public Universities: Cyprus University of Technology, Open University of Cyprus, University of Cyprus

Private Universities: European University, Frederick University, Neapolis University, UCLan Cyprus, University of Nicosia

Information and Communication Technologies (ICT)

.jpg)

ICT is an important driver of productivity, growth and economic performance crossing horizontally all sectors of the economy. The government of Cyprus has identified ICT as one of the country’s priority growth sectors and has developed a Digital Strategy and Action Plan for immediate implementation. Furthermore, in order to promote applied research, development, innovation, technology and entrepreneurship in Cyprus, the Government is looking to promote the establishment of a new large scale Science Technology Park (STP). It is a high impact project, that will host research centres, business incubators, spin-off innovative enterprises and other local and international knowledge based companies, with the aim of promoting new and more competitive knowledge-based products and services.

Main advantages and opportunities of the ICT sector:

• ICT Ecosystem: Major multinational firms in the ICT industry, including ICT consulting firms, operate regional headquarters in Cyprus using the country as a regional base and gateway (into and out of the EU) for corporate services, such as sales and marketing, project management, software development, systems integration, testing services, training and development, disaster recovery and business continuity, as well as joint R&D among countries of the region.

• EU Research Funds: As an EU member state, Cyprus attracts EU research funds for Industry-University partnerships. Invest Cyprus acts as a catalyst for the provision of advanced R&D infrastructures and Cypriot talent to foreign companies, who wish to establish Industry-University partnerships with the Cyprus network of Universities and Research Centres. The Cyprus Research Promotion Foundation is currently evaluating and funding companies and projects that have their R&D facilities in Cyprus

• Taxation: Cyprus offers an attractive and fully transparent tax regime, fully compliant with EU, OECD and international laws, with one of the lowest corporate income tax rates in the EU at 12.5% and an attractive IP regime.

New IP Box main features:

• Cyprus IP box is fully aligned with the OECD/G20 BEPS Action 5 report.

• The regulations will provide that qualifying IP types will include patents and copyrighted software.

• 80% deductions is provided for qualifying profits from qualifying IP.

• In effect, only 20% of the qualifying profits will be taxed at the rate of 12.5%.

• A taxpayer may elect not to claim all or part of the available 80% deduction for a particular tax year.

• Qualifying tax losses in the new Cyprus IP box are restricted to 20% of their amount.

• The closing of the old Cyprus IP box with transitional rules up to June 30, 2021.

Cyprus welcomes and has the know-how to support Foreign Direct Investment for expansion and development of projects on e-Government, e-Business, e-Learning, e-Inclusion, e-Health and overall ICT services. The country has aligned its ICT and innovation strategy with the flagship initiatives “Digital Agenda for Europe” and “Innovation Union” of the “Europe 2020” growth strategy of the EU.

Larnaca Cyprus International Airport

Facilities

The airport has one primary passenger terminal. Departures are accommodated on the upper level, while arrivals at the ground level. A second "VIP terminal" also exists, which is used for visiting heads of state, some private aviation, and for cargo. The airport utilises a single large apron for all passenger aircraft. The concept architectural design of the passenger terminal was developed by French architects at Aéroports de Paris (ADP) with Sofréavia in France. Detail and Tender design was completed in Cyprus by 1998, with local architectural office Forum Architects and a large engineering team under the coordination of ADP. The design was later used as a base for the BOT projects of both Larnaca and Pafos International Airports though significant changes were made mainly on "value engineering" grounds.

A large amount of controversy spurred by the local media surrounded the granting of the contract when it was put out to tender. A consortium led by BAA and Joannou & Paraskevaides (J&P) construction quickly pulled out when it did not receive assurances from the government of Cyprus that it would receive financial compensation in the event that direct flights were allowed between Northern Cyprus and the rest of the world. The contract was eventually hastily granted to the next best bidder, the French led 'Hermes' Consortium. This too, was not free of controversy, causing legal challenges by BAA and J&P, and adding further delays to a much needed project.

Upgrades

A €650m upgrade of the Larnaca and Paphos airports was completed in 2006. The international tender was won by Hermes Airports, a French-led group. The consortium is made up of Bouygues Batiment International (22%) Egis Projects (20%), the Cyprus Trading Corporation (a local retail group-10%), Iacovou Brothers (a local contractor-10%), Hellenic Mining (10%), Vancouver Airport Services(10%), Ireland's Dublin Airport Authority (Aer Rianta International) (10%), Charilaos Apostolides (a local construction company-5%) and Nice Côte d'Azur Airport (3%). Hermes Airports built new passenger terminals and plans to extend the runways at both airports under a 25-year concession.

A new terminal building opened on 7 November 2009. It has 16 jetways (boarding bridges), 67 check in counters, 8 self check-in kiosks, 48 departure gates, and 2,450 parking spots. The new terminal can handle 7.5 million passengers per year. Infrastructure also features a large engineering hangar, a cargo terminal, and separate facilities for fuelling and provisioning light aircraft. There is a second, smaller apron where cargo aircraft and private aircraft are often parked. There are also spaces for smaller aircraft for flying schools and privately owned aircraft separate from the main two aprons.

Innovation and Start-Ups

Creating value through ideas and having the potential of becoming a key driver of economic growth, the development of the Start-Ups sector is deemed of great importance for Cyprus. In this direction, significant incentives have been introduced by the Cyprus government in order to boost innovation and enterpreneurship, such as the approval of a package of tax incentives of investment into start-ups, as well as the introduction of the Start-up Visa for third country nationals.

Tax Incentives

The tax incentives package includes an up to 50% tax exemption on investment in innovative and start-up companies. The exemption will be afforded to individuals who invest in an innovative enterprise, either directly or through an investment fund. The maximum annual amount to be exempted is €150,000. The investment could be in the form of acquiring shares, a loan, or providing guarantees to innovative enterprises.

To be considered innovative, a company must have spent 10% of its operating expenses on research and development in at least one of the last three years, a fact which will be determined by an external auditor. Start-ups will be assessed based on their business plan.

The definition of innovative enterprise has also changed. To date, the definition was limited, only including specific sectors of research and development. Now it covers a wide spectrum that is not restrictive and can be effectively used by businesspeople, young people with innovative ideas that can be turned into entrepreneurship and commercial products.

Start-Up Visa

The Cyprus ecosystem is further enhanced with the introduction of the Start-up Visa for third country nationals. This scheme concerns individual investors and groups of investors who will be in a position to establish a startup in Cyprus.

These investors will have to be citizens of third countries, with a 50 thousand euro capital, who will set up their headquarters and their tax residency in Cyprus, will be university graduates and have a good knowledge of either Greek or English, while businesses must be certified r.

Intellectual Property (IP) regime)

The new regulations introduce the OECD recommended “nexus approach.” This approach limits application of the IP box regime if research and development (R&D) is being outsourced to related parties. The approach links the benefits of the regime with the R&D expenses incurred by the taxpayer.

As per the new IP box regime, qualifying taxpayers will be eligible to claim a tax deduction equaling 80% of qualifying profits resulting from the business use of the qualifying assets. A taxpayer may elect not to claim the deduction or only claim a part of it.